News Release – Vancouver, British Columbia – August 23, 2022: Monumental Minerals Corp. (“Monumental” or the “Company”) (TSX-V: MNRL; FSE: BE5; OTCQB: MNMRF) is pleased to announce that it has signed a letter of intent (“LOI”) to acquire a 50.01% interest in the Salar de Turi Project (the “Project”) from Lithium Chile Inc. (“Lithium Chile”) located within the Lithium Triangle about 120 km northwest from the Salar de Laguna Blanca and 60 km northeast from the City of Calama, Chile.

The Salar de Turi Project is located within the prolific Lithium Triangle (“LT”), a zone within the central Andes high desert that includes Chile, Argentina, and Bolivia (Figure 1). The LT zone is estimated to contain more than half of the world’s lithium supply beneath the many salt flats, also known as salars, that are common to the region. The Project comprises 31 exploration concessions totalling 8,500 hectares, 100% owned by Lithium Chile through its wholly owned Chilean subsidiary Minera Kairos Chile Limitada (“Minera Kairos”). The Project is accessible from the City of Calama (60 km to the southwest) via the paved roads 21CH, and B-165 and is close to infrastructure. Travel time from Calama to the Project is approximately 1 hour.

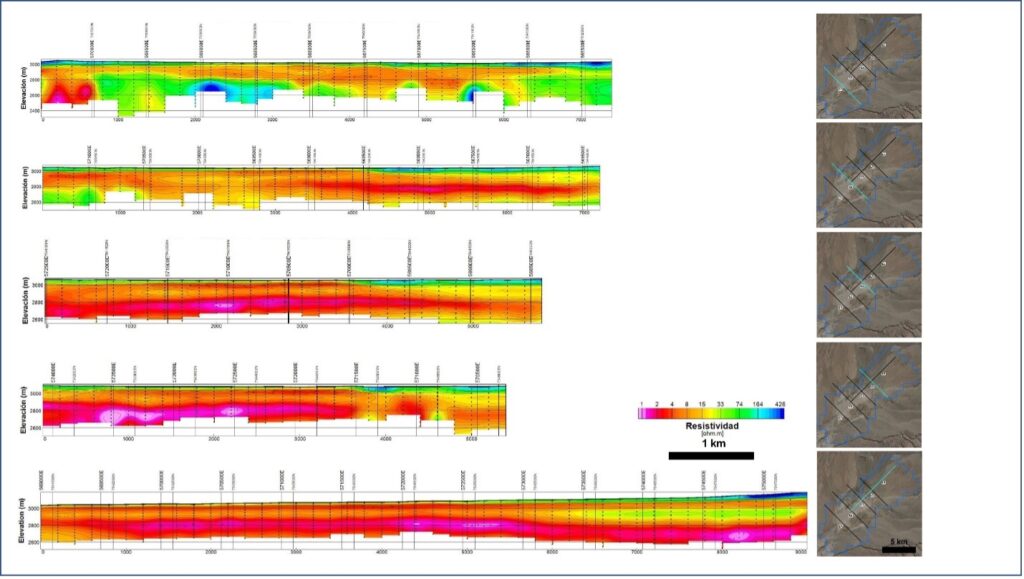

Figure 1. Location of the Salar de Turi Project and the 31 claims (8,500 ha) that it encompasses. Map also includes the transient electromagnetic (TEM) survey lines (L1 to L5) contracted by Lithium Chile in 2019.

Jamil Sader, CEO and Director of Monumental Minerals comments, “The relationship we have built with Lithium Chile continues to develop into a growing joint effort to advance high-value salars towards lithium brine resources. The Salar de Turi Project represents a great opportunity, with highly compelling geophysics and geochemistry, excellent infrastructure, and year-round access. Monumental plans to move forward with exploration activities with the same vigour as with our other two critical metals projects, Laguna Blanca lithium brine, and Jemi heavy rare earth elements.”

Steve Cochrane, CEO and Director of Lithium Chile comments, “During a recent trip to Chile, I met with Monumental Minerals technical and social governance team, and I feel that they have the capability as demonstrated with Laguna Blanca, to advance the Salar de Turi Project. This joint venture will benefit both parties substantially with Lithium Chile being the largest shareholder of Monumental Minerals. The Joint venture is consistent with our desire to maximize the return on our Chilean assets while our focus is on our Arizaro Argentinian development program.”

Figure 2. Cross-sectional profiles of the TEM surface contracted by Lithium Chile in 2019.

Terms of the Proposed Transaction

Subject to the execution of a definitive agreement (“Definitive Agreement”), Monumental will have the option to earn-in up to a 50.01% interest in the Salar de Turi Project by making certain staged cash payments and issuing common shares to Lithium Chile and incurring exploration expenditures on the Salar de Turi Project as follows:

- Make cash payments of an aggregate of C$700,000 according to the following schedule:

- $200,000 upon final TSX Venture Exchange approval of this proposed transaction (the “Acceptance Date”);

- $250,000 on or before the fourteenth (14) month anniversary of the Acceptance Date; and

- $250,000 on or before the second anniversary of the Acceptance Date.

- Incur minimum expenditures on the Salar de Turi Project of not less than an aggregate of C$1,400,000 according to the following schedule:

- $700,000 on or before the first anniversary of the Acceptance Date; and

- $700,000 on or before the second anniversary of the Acceptance Date.

- Issue and deliver to Lithium Chile, that number of common shares of Monumental that would result in Lithium Chile holding, on a non-diluted basis, 9.9% of the issued and outstanding common shares of Monumental (the “Payment Shares”), within ten (10) days of the closing of Monumental’s next completed financing (if any occurs) following the Acceptance Date, but no later than the twelve (12) month anniversary of the Acceptance Date, unless otherwise mutually agreed to by both parties.

In addition to the statutory hold period of four months and a day from the date of issuance, the Payment Shares will be subject to a 12-month voluntary hold period from the date of issuance. Upon Monumental earning a 50.01% interest in the Salar de Turi Project, Monumental and Lithium Chile will use commercially reasonable efforts to negotiate and execute a joint venture agreement for the purpose of jointly carrying out exploration, evaluation and development of the Salar de Turi Project.

Further details regarding the proposed transaction with Lithium Chile will be provided in a comprehensive news release if, and when, the parties enter into the Definitive Agreement. The proposed transaction between Monumental and Lithium Chile is subject to, among other things, the execution of the Definitive Agreement and TSX Venture Exchange approval.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Kristopher J. Raffle, P.Geo. (BC) Principal and Consultant of APEX Geoscience Ltd. of Edmonton, AB, a Director of the Company and a “Qualified Person” as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Monumental Minerals Corp.

Monumental Minerals Corp. is a mineral exploration company focused on the acquisition, exploration, and development of mineral resource properties in the critical and electric metals sector. The Company’s flagship asset is the Jemi HREE project located in Coahuila, Mexico near the Texas, USA border which the Company has an option to acquire 100% of the 3,650-hectare project. The Company has an option to acquire a 75% interest and title to the Laguna cesium-lithium brine project located in Chile and is actively seeking new lithium brine opportunities in Chile.

On behalf of the Board of Directors,

/s/ “Jamil Sader”

Jamil Sader, Chief Executive Officer and Director

Contact Information:

Email: [email protected]

Or

Max Sali, VP Corporate Development and Director

Email: [email protected]

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Forward Looking Information

This news release contains “forward‐looking information or statements” within the meaning of applicable securities laws, which may include, without limitation, the potential plans for the Company’s projects, the completion of the definitive agreement with Lithium Chile and the TSX Venture Exchange’s approval of the proposed Turi transaction, other statements relating to the technical, financial and business prospects of the Company, its projects and other matters. All statements in this news release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Such statements are based on numerous assumptions regarding present and future business strategies and the environment in which the Company will operate in the future, including the price of metals, the ability to achieve its goals, that general business and economic conditions will not change in a material adverse manner and that financing will be available if and when needed and on reasonable terms. Such forward-looking information reflects the Company’s views with respect to future events and is subject to risks, uncertainties and assumptions, including the risks and uncertainties relating to the interpretation of exploration results, risks related to the inherent uncertainty of exploration and cost estimates and the potential for unexpected costs and expenses and those other risks filed under the Company’s profile on SEDAR at www.sedar.com. While such estimates and assumptions are considered reasonable by the management of the Company, they are inherently subject to significant business, economic, competitive and regulatory uncertainties and risks. Factors that could cause actual results to differ materially from those in forward looking statements include, but are not limited to, continued availability of capital and financing and general economic, market or business conditions, failure to secure personnel and equipment for work programs, adverse weather and climate conditions, risks relating to unanticipated operational difficulties (including failure of equipment or processes to operate in accordance with specifications or expectations, cost escalation, unavailability of materials and equipment, government action or delays in the receipt of government approvals, industrial disturbances or other job action, and unanticipated events related to health, safety and environmental matters), risks relating to inaccurate geological assumptions, failure to maintain all necessary government permits, approvals and authorizations, failure to obtain surface access agreements or understandings from local communities, land owners or Indigenous groups, fluctuation in exchange rates, the impact of Covid-19 or other viruses and diseases on the Company’s ability to operate, an inability to predict and counteract the effects of COVID-19 on the business of the Company, including but not limited to, the effects of COVID-19 on the price of commodities, capital market conditions, restriction on labour and international travel and supply chains, decrease in the price of rare earth elements, lithium, cesium and other metals, loss of key employees, consultants, or directors, failure to maintain community acceptance (including from the Indigenous communities), increase in costs, litigation, and failure of counterparties to perform their contractual obligations. The Company does not undertake to update forward‐looking statements or forward‐looking information, except as required by law.